Hans Mitterlechner is a director at aviation consultancy ASM Australasia, a partnership between ASM Global and Three Consulting.

Australia and Tourism

Australia isn’t an easy international travel destination—far away from most source countries, relatively expensive and burdened with not necessarily easy visa procedures. Yet, Australia remains a bucket list item, high on the list of aspirational travel destinations throughout the world, with around 8.7 million visitors making it to our shores in 2019.

Considering “tourism” as the wider definition, international tertiary education represents a core Australian export: in 2019, there were around 750,000 international students in Australia, making the country one of the most sought-after international student destinations in the world.

Australia’s Federal Department of Foreign Affairs and Trade lists “education related travel services” as the country’s third and “personal travel services” as the fifth most important export item, collectively accounting for some 13{32bc5e747b31d501df756e0d52c4fc33c2ecc33869222042bcd2be76582ed298} or around A$55 billion ($39 billion) of Australia’s exports.

In 2019, Tourism Research Australia forecast cumulative international tourism growth of 57{32bc5e747b31d501df756e0d52c4fc33c2ecc33869222042bcd2be76582ed298} during the decade to 2029, even topped by cumulative growth in international spend of 63{32bc5e747b31d501df756e0d52c4fc33c2ecc33869222042bcd2be76582ed298}. The pre-pandemic forecast predicted 14.6 million visitors to arrive in Australia in 2029.

As far as outbound travel is concerned, Australians are among the most frequent fliers in the world, undoubtedly helped by our location on the globe and the fact that there are no land borders. In 2019, Australians produced around 11 million international trips, which translates into a very high international travel propensity of 0.44 trips per capita.

Hard Border Closure

Along with most countries around the world, Australia introduced border restrictions in late March 2020 because of the onset of the COVID-19 crisis. Non-citizens and non-permanent residents couldn’t enter Australia anymore, while citizens and permanent residents required a permit to leave (and re-enter) their home country.

Non-permanent residents were asked to leave the country as any help offered by federal or state governments would not extend to them. Whoever entered Australia needed to go through a mandatory 14-day hotel quarantine, enforced by Border Force (the Australian immigration authority) as well as respective state police forces.

Initially, hotel quarantine was paid for by the federal government, but this became the traveler’s responsibility within the first three months of the introduction of the scheme and was charged at $3,000 for the 14-day period. As every inbound traveler had to have a guaranteed hotel quarantine room, airlines weren’t able to sell to satisfy demand but only up to the hotel room capacity allocated to them on a weekly basis.

While Australia’s international airlines, Qantas and Virgin Australia, stopped all international operations within weeks of the outbreak of the pandemic, hotel quarantine capacity constraints left most services by international airlines unprofitable, leaving many with no choice but to suspend operations.

By mid-2020 the situation was dismal, with thousands of Australians stranded abroad, airlines continually forced to cancel flights, change schedules, and returning citizens paying upwards of $6,000 for a one-way trip to their home including mandatory hotel quarantine. We need to thank foreign airlines—such as Qatar Airways, Emirates, Singapore Airlines, United Airlines, Air New Zealand, and China Southern—who shouldered the burden of returning Australians throughout 2020 and 2021 and also kept international trade connections alive.

Coming back to border closures, Australia didn’t just stop at its international border. Australia is a Commonwealth consisting of six states and two territories with these states and territories holding significant powers—powers most ordinary Australians wouldn’t have known about just two years ago. One of them is the right of the executive branch of states and territories, led by premiers (in states) and chief ministers (in territories) to manage their own borders.

Officially justified by each state’s own medical advice but very often driven by political grandstanding and positioning, Australia’s eight states and territories introduced a confusing series of border closures and openings, some impacting all other states, some others not, making inter-state domestic travel generally unpredictable for most of 2020 and 2021.

As a matter of fact, the last inter-state border closure fell on March 3, 2022, when Western Australia reopened its state to all others after almost two years. While many other countries enjoyed a surge in domestic travel, Australians were not only restricted to their own country, but further to their own state for much of their COVID life of the past two years. Instead of benefiting from a booming domestic industry, visiting some of the world’s most sought-after destinations, Australia’s higher than average travel propensity was curbed.

In summary, Australia introduced some of the harshest and longest lasting border restrictions anywhere in the world, made even more severe by domestic restrictions which earned us the nickname “Fortress Australia” which some locals re-interpreted as “Prison Australia.”

Border Opening

As Australia’s vaccination rate rose and political pressure built, the federal government opened the country’s international border in three steps. Citizens and permanent residents regained their right to leave and enter the country without requiring a permit to do so from November 2021.

International students and skilled migrants were allowed to enter the country from mid-December and Australia was re-opened to all other visa holders from Feb. 21, 2022—23 months after the borders first closed.

Clearly, Australia was able to flick a switch, introduce harsh rules, close its borders, restrict international travel to an absolute minimum and make use of its geography to execute these rules. Now, are we able to do the opposite? Flick the switch again, take away the rules, open our borders and go back to the status quo of 2019? Ever optimistic and opportunistic politicians will want to make you believe that this is the case, but we in the industry are a little sceptical.

Thoughts On Travel Recovery

Realistically, we must expect the international travel recovery to be bumpy. There are some structural issues that would apply worldwide and, we think, a few specific Australian issues to be factored in on top of general developments.

Upfront, it must be kept in mind that international travel in 2022 is very different from travel in 2019. Virtually every single country has its specific entry rules, usually consisting of vaccination and testing requirements, updated, adopted and changed in irregular intervals. Airline rules and requirements come on top of that. Sadly, while there was a lot of talk about world-wide standards for vaccinations and tests and documentation thereof, today’s reality is a piecework of rules that change without notice. That makes travel not only less predictable—a positive test will change plans just a few days from or the intended day of travel—but also more expensive.

As governments around the world are expected to find the right balance between public health and economic results, we should expect specific entry requirements to stay with us for some time to come. Further virus mutations, which realistically will occur, will only further justify maintaining health-related entry stipulations. For (mostly) private health providers, the requirement for non-government financed PCR tests is a massive windfall, so it is safe to assume that these organizations and their lobby groups want to keep testing regimes for as long as possible.

So, the onus is on the international traveler who, now, in addition to the striptease at airport security and the confiscation of half empty bottles of water, will need to fulfill vaccination requirements and pay for tests to be allowed to travel.

In terms of recovery back to 2019 levels, we see differences by purpose of travel. We expect VFR-related travel to recover relatively quickly. After two years of—in many cases—involuntary isolation, families and loved ones will want to compensate for a lack and maybe even loss of contact, regardless of distance and, to a degree, cost. Arguably, over the next year or so, VFR might be the most inelastic of all travel purposes.

Following post-pandemic travel development in Europe and the US, we see leisure travel as the second strongest performer, driven by pent-up demand that was built up over a two-year period. Short and medium-haul travel is expected to recover more quickly as testing requirements tend to be less rigorous across shorter distances, especially within the EU and North America.

Also, as the world has started to live with COVID, new infections have remained on relatively high levels, meaning a traveler, regardless of vaccination status, might get infected while away from home, which for many would be a daunting prospect. Psychologically, the average traveler would like to be closer to home in that situation, again making the case for a quicker recovery of short and medium-haul international travel.

Business travel has become the problem child of aviation. Over the past 24 months, every single one of us has experienced the power and convenience of videoconferencing and working from home. Both are expected to have a lasting impact on how we conduct business over years to come.

While it is not suggested that virtual meetings are able to compensate, let alone replace personal meetings, conferences, exhibitions and so forth, the fact is that companies will see a reduced need to send their executives traveling, for cost as well as health reasons. Consequently, business travel is forecast to develop at a slower pace than both VFR and leisure travel.

We expect that Australia will need to deal with some additional issues. As per the introduction, we are far away from most anywhere in the world. While travel between Australia and Asia has developed rapidly over the past decade, a short and very popular route between Perth and Denpasar takes around four hours, another heavily travelled route between Sydney and Singapore takes around eight hours, while the flight from Melbourne to Beijing takes around 12 hours. Sydney is around 14 hours from Los Angeles and some 24 hours from Europe’s main population centers.

That makes the decision to come to Australia, especially for leisure purposes, a rather big one and most definitely not a last-minute one. Combined with what has been said about general travel trends, the often quoted “tyranny of distance” is thought to be a larger burden as the world’s post-pandemic travel patterns normalize.

Last but not least, we should expect that brand “Australia” took a hit over the past 24 months. It was well documented throughout the world, how Australia, its federal as well as state and territory governments, treated non-citizens as well as citizens and permanent residents as a consequence of various actions to curb the spread of the pandemic.

Asking non-residents to leave because they won’t be financially supported and, at one point, threatening citizens with jail time for the crime of wanting to return back to home are among the low points here. Adding Australia’s track record in immigration matters, climate change and the current government’s rhetoric vis-à-vis China, suggests that a lot of image repair work needs to be done to reclaim our position as one of the world’s most aspirational travel destinations.

Forecasting And Conclusion

Traffic forecasting is a combination of science, mathematics and gut feel, where the current situation, further complicated by geopolitical tensions in Europe and crude oil prices at the highest levels since 2014, tends to over-extend the latter.

To counter what are high levels of uncertainty, we have consciously departed from the one scenario/one forecast approach and suggest doing quite the opposite: create a range of crisis and post-crisis demand scenarios where each of them is “headlined” with specific assumptions with respect to health, demographic and economic frameworks defining these scenarios (e.g. vaccination ratios, establishment of “travel bubbles”, Australia’s image abroad, etc.). We will then consider how fiscal year (FY) 2019 (12 months ending June 2019) travel segments react in each of these scenarios, and what percentage of those volumes are likely to be recovered on a month-by-month, season-by-season or year-by-year basis.

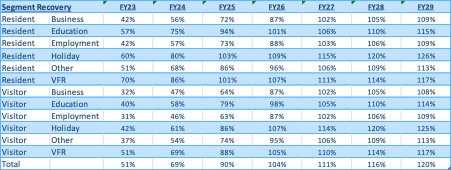

We created a forecasting model that segments Australia’s FY 2019 international traffic by direction (resident outbound/visitor inbound), purpose (business, holiday, VFR, employment, education, other), and country (destination for residents/origin for visitors) and that enables us to simulate different recovery ratios by segment.

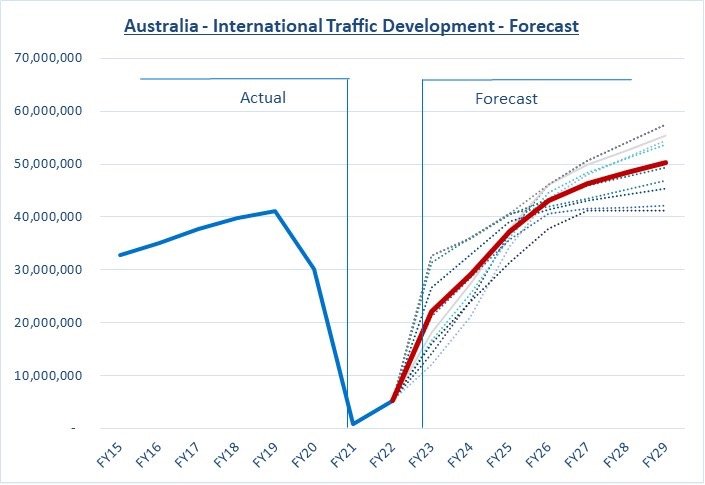

We then created 10 different forecasts by manipulating segment recovery ratios between FY23 and FY29, each representing a different set of assumptions around the theme developed in the sections above as to how markets and segments will perform over the coming years. The “Base” forecast is defined as the average of all scenarios run through the model.

As shown in the table below, segments are forecast to recover at different speeds, leading to the average forecast as shown in the graph below. One of the important points to note is that we don’t expect Australia’s international traffic to recover back to FY19 levels until late 2025. That might appear subdued but is driven by the considerations and concerns presented above.

Of particular concern is the development of most inbound visitor traffic segments where the “flicking of the switch” itself is not deemed sufficient to quickly return to past traveler levels.

Australia will face stiff competition, in particular for the holiday and education segments, and will need to develop comprehensive market recovery strategies, ideally combining the efforts of Federal and State Governments, Tourism Australia, state tourism organizations, gateway airports as well as international airlines.

It is clear that a lot of volatility remains in how the current health crisis develops keeping industry uncertainty levels extraordinarily high; this strongly suggests to update forecasts more regularly than in the past.

More Stories

How to Pack for the UK Weather (Yes, Even in July!)

An Entrepreneur’s Guide To Responsible Travel

Important Updates on Passport Processing